As we begin 2025, investors are as divided as ever on the financial outlook for 2025. We have the optimistic “bulls” and the cautious “bears.”

On the bull side, optimism centers on a pro-business administration and the potential for strong economic growth driven by a boost in corporate earnings. There is enthusiasm around a potential industrial revolution fueled by artificial intelligence. Why sell stocks? We are only at the beginning of a secular bull market! Conversely, the bear side is concerned with the highest valuations we've seen since the late 90s, the fear of reigniting inflation, and heightened geopolitical risks globally. As well, greed and euphoria in the markets are at an all-time high. Why buy stocks? We could be heading straight into another financial crisis.

Both sides present compelling arguments. So, what should we do? We like to say that the answer to all questions is diversification, which truly remains one of the best risk mitigators available. Worried that tariffs might cause inflation to soar again? That’s okay; we have investments in your portfolio that can help mitigate unfavorable inflation and interest rates environments. Concerned this could be 1999 all over again, leading to another “tech wreck”? Or wondering if this is more like 1996, with a potential for three more years of 25%+ returns driven by tech? Either way, we are covered.

Our portfolios are diversified across thousands of stocks and sectors, both public and private, to mitigate the risks we see today. The portfolios are designed with hedges in place to account for market uncertainties. By hedging those risks, you may not achieve sky-high returns during a bull market, but you may also avoid severe declines that could jeopardize your financial plan in a bear market. History has consistently shown that diversified portfolios tend to provide more stable returns over the long term, minimizing drawdowns and allowing investors to better weather market turbulence.

We encourage you to block out the external noise and feel confident that your money is appropriately positioned in the “middle lane”, focused on individualized risk-adjusted returns to support your financial plan. We look forward to a prosperous 2025!

The opinions expressed are those of Freund & Smith Advisors as of the date stated on this e-mail and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

Sincerely,

Freund & Smith Advisors

As the New Year approaches, it is customary for individuals to reflect on their lives and set resolutions for self-improvement and personal growth. While common resolutions often focus on health, career, or personal achievements, dedicating a New Year’s resolution to becoming more philanthropic can have a profound impact on both you (the giver) and the community. Embracing philanthropy as a resolution encourages the cultivation of compassion, social responsibility, and a deeper connection with the world around us.

One of the primary benefits of committing to philanthropy is the sense of fulfillment and purpose it provides. Engaging in acts of giving, whether through financial donations, volunteer work, or community initiatives, fosters a sense of belonging and interconnectedness. By prioritizing the well-being of others and contributing to causes that resonate with our values, we experience a heightened sense of gratitude and therefore, a more positive outlook on life.

That’s why we are implementing a philanthropic New Year’s resolution as a firm. We are going to do more in 2025. What does that mean to our firm? We are going to increase our team commitment to quarterly in person volunteering at local organizations. In addition, we are going to give more because we are passionate about helping the organizations that mean the most to our clients. We hope it will create a ripple effect, inspiring other to contribute and make a difference. By sharing our impact and encouraging our clients to get involved, our efforts extend far beyond our individual actions. In committing to be more philanthropic, we not only enhance our own lives, but we also contribute to building a more compassionate and equitable world.

Each year, the Social Security Administration announces various changes to social security benefits, and it is prudent for retirees and those nearing retirement to stay informed on they may be affected. The changes are not only to the benefits themselves, but also the taxes that support them. Here are four changes you should know:

- Social Security benefits will increase 2.5% due to the cost-of-living adjustment (COLA): The COLA benefit is dictated by the Consumer Price Index (CPI) during the third quarter of the previous year. Since the CPI was up 2.5% in third quarter of 2024, Social Security benefits will increase by that amount. One thing to note, many people don’t realize that your benefit amount will never go down due to deflation so even when inflation is zero or less, there will be no change to a retiree’s check.

- Some employees will pay more in payroll taxes: Social Security is funded by a payroll tax, but it is subject to a cap. In 2024 the maximum taxable income was $168,600. In 2025, it will increase to $176,100. Therefore, any income exceeding $176,100 will be exempt from Social Security payroll tax.

- The maximum Social Security benefit for those newly retired will increase: To accrue the biggest monthly payout possible, a worker would have to equal or exceed the taxable earnings limit set by the Social Security Administration for at least 35 years. A worker would also need to wait until they reach age 70 to file for social security benefits providing them delayed retirement credits. The maximum monthly benefit is expected to increase to $5,108 in 2025, from $4,873 in 2024.

- Retirees under Full Retirement Age can earn more money before their Social Security benefits are withheld: There are two Retirement Earnings Test (RET) amounts to be aware of- a lower limit that applies to Social Security beneficiaries who do not reach full retirement age (FRA) during the year, and a higher limit for beneficiaries who do reach FRA during the year. These limits have been revised to $23,400 and $62,160 respectively.

When it comes to life insurance, there are many misconceptions which make getting the coverage you need easy to ignore or put off. Maybe you think you’re too old, too young, or just not in the right financial situation. In reality, it’s usually a good idea to consider buying life insurance sooner rather than later. It’s not just about your family’s financial security if you happen to pass away. The right life insurance policy can offer numerous benefits while you’re still alive too.

Don’t let misinformation dissuade you. Here are three common myths about life insurance, debunked.

1. “My job offers life insurance. That’s good enough.”

Many employers offer life insurance as a benefit, but the amount of insurance offered can vary. Often times the death benefit is a multiple of your compensation as an employee – for instance, two or three times your salary. That amount could be far too low to cover funeral expenses, outstanding debts and other costs, so it’s important to put some thought into how much your family would need if you pass away. Additionally, that employer-based insurance policy goes away entirely if you leave your job or retire. Statistically, that means the policy is likely to go unused.

2. "I’m a stay-at-home parent. If I don’t contribute to my household income, I don’t need life insurance.”

Life insurance can be used to replace the income of a working spouse, but it’s just as important for helping to pay expenses that may arise with the loss of a stay-at-home parent. With you gone, your family members would be left with a significant financial burden even if you’re not contributing to your household with a paycheck. The primary role of a stay-at-home parent is often childcare and the cost of outsourcing it continues to soar. More than half of parents surveyed by Care.com reported that childcare accounts for 20% of their expenses. A stay-at-home parent’s life insurance death benefit can help cover these costs and others that arise. That same money can be used for immediate costs like funeral expenses.

3. “I’m over 65. I don’t need life insurance anymore.”

By the time you reach 65 you may have fewer people depending on you financially, but many permanent life insurance policies still can play an important role in a financial plan. When you purchase a whole or permanent life insurance policy, it will accrue cash value as you pay your premiums. These funds aren’t usually tied to financial markets, so it’s available for you to access while you’re still alive. This also means the cash value typically won’t decline when the market is down, so you have the option to access it instead of selling your investments that have lost value. Your life insurance policy could essentially provide a financial cushion to ride out a market downturn so you can wait for investments to recover before selling them.

Don’t let myths and misinformation keep you from making smart financial decisions. If you’re unsure about kind of life insurance policy is right for you and your family, working with a financial advisor is a great way to help you understand your options and show you how the various pieces of your financial life can come together to help you reach your goals. Regardless of your situation, it’s likely there’s a life insurance policy that will fit your financial planning needs and budget.

Navigating Election Season: Trusting Your Financial Plan Amid Political Turbulence

Election season in America seems to bring about a time of tension and uncertainty within the country. The results have effects that ripple through many aspects of our daily lives. From the economy, to social divide, a lot can change with one election. However, during an election season it is crucial to trust your financial plan and avoid letting political turbulence influence your financial decisions.

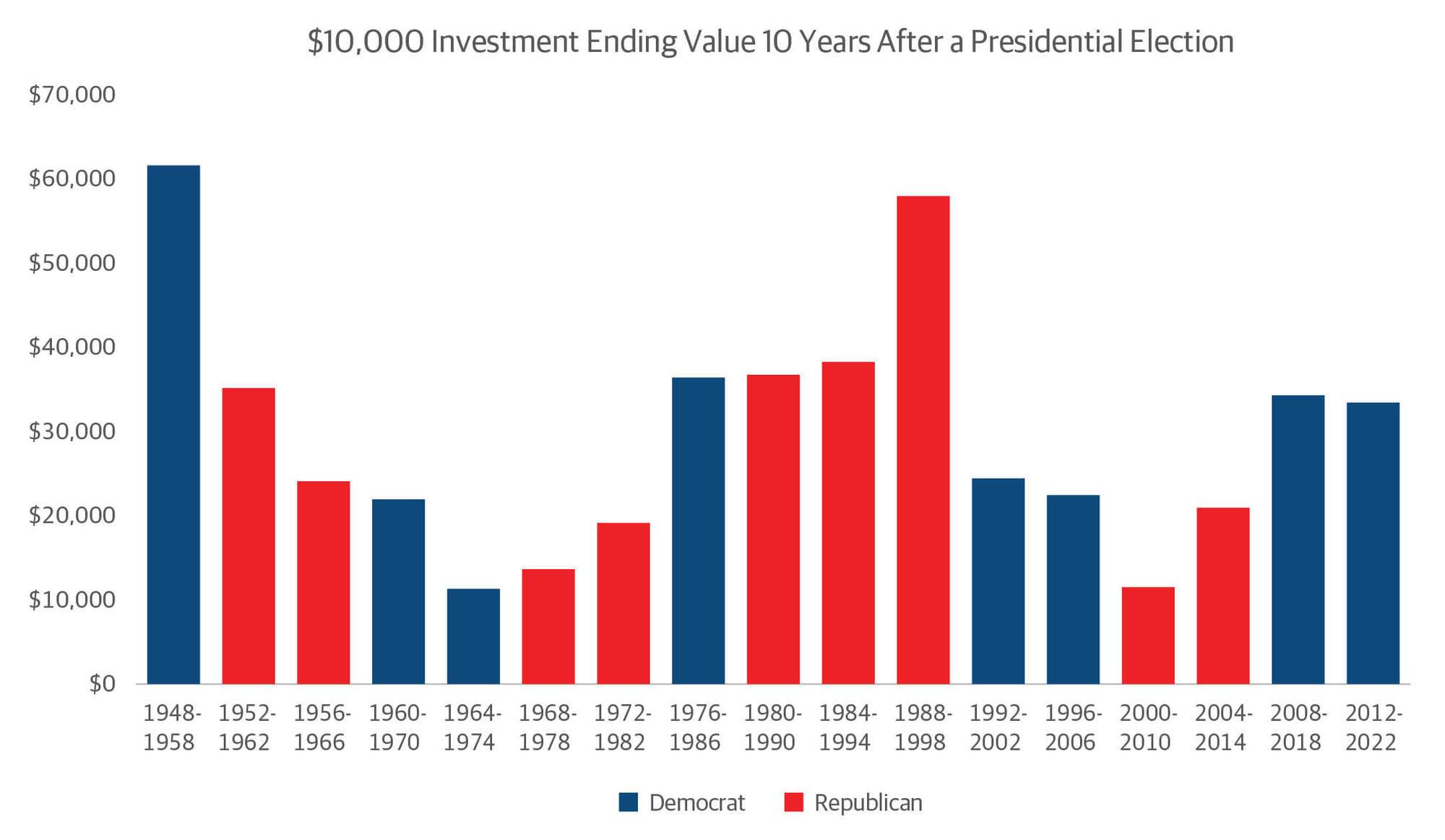

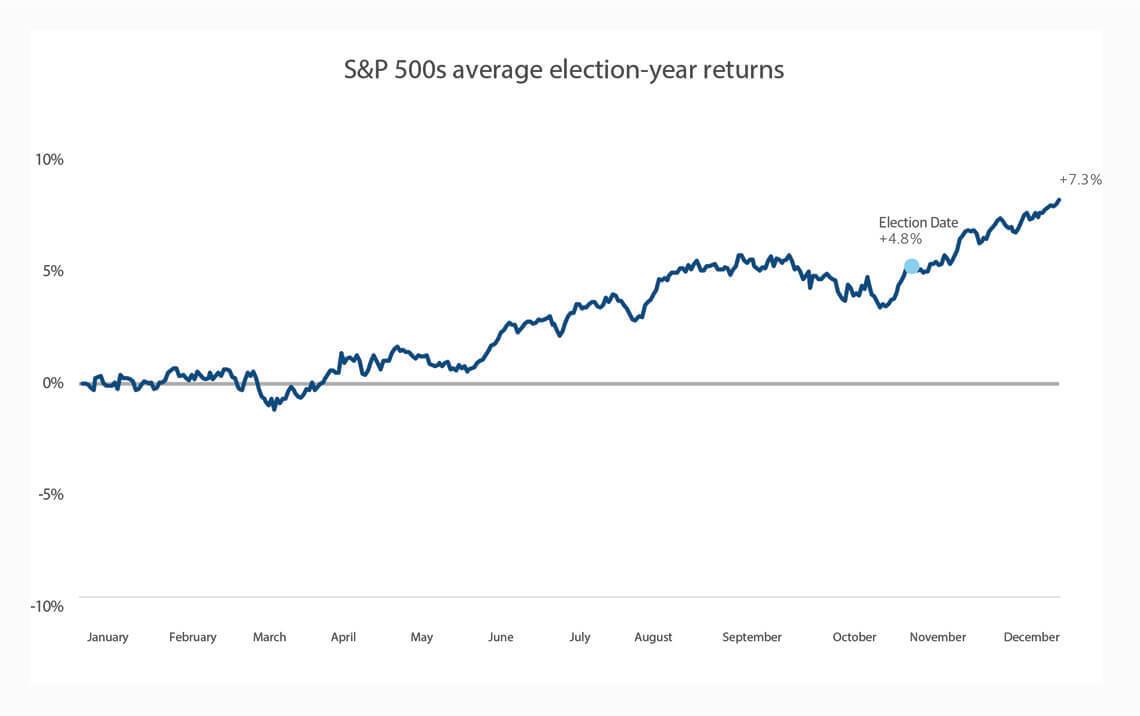

Maintaining confidence in a well-researched plan helps people stay focused on their long-term goals. Reassessing based on the fundamentals of your investments, rather than reacting to short-term political events, ensures you remain correctly aligned with your goals and risk tolerance. History has shown that no matter which party or candidate is in office, the American economy has been able to stabilize and strengthen. This shows that politics should not overrule how you think about investing. The chart below shows the Performance of $10,000 dollars, invested in November of each election year.

S&P 500 data is from Morningstar Direct. This study looked at all election years starting with 1952 and ending in 2020. All returns are price returns. Past performance is no guarantee of future performance. All investments carry risk, including loss of principal invested.

More info

The biggest takeaway from this is that in the last 17 elections since 1948, an investment of $10,000 into the Stock Market and held for 10 years, would result in a positive return value in every instance. 13 of the 17 elections would see the investment at least doubled with no regard to which party is in office. This big picture perspective demonstrates that political leadership is not a reliable indicator of whether the market will go up or down. One should feel more comfortable staying true to their investment strategy when dealing with a turbulent election season, such as what we are experiencing this year. By doing so, one can assess and make educated decisions based on which candidate best fits their beliefs on how the country should be governed.

When evaluating candidates, it is particularly essential to consider not just their promises but also whether their platforms align with your fundamental values and ethics. Analyzing a candidate’s stance on key issues can help determine if their proposed solutions match your expectations for governance. This is important because history has shown us that no matter who is in office, Republican or Democrat, the U.S. GDP and S&P Index will most likely be growing.

Large cap stocks are represented by the S&P 500 Total Return Index. Investment returns are monthly and start on November 1st of each election year. All data is from Morningstar Direct. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. The data assumes the reinvestment of all income and does not account for taxes or transaction costs. Returns and principal invested in stocks are not guaranteed.

More info

Your financial future should not be dictated by the changing political climate. Staying true to your values, fundamentals, and trusting your financial plan is crucial for an investor. Vote for a candidate who best reflects your personal beliefs based on their policies and past actions. By doing so, you will be ready to handle whatever the election brings, while staying on track to achieve your long-term financial goals.

August 2024

The race to obtain more time, health and money is ongoing. At younger ages, we have an abundance of health and time but lack the financial resources to fully take advantage of our freedom. As time goes on, our time and health shrink as our financial independence grows. Later in life, financial abundance is most often achieved only to be accompanied by nagging or even serious health concerns. Ask yourself this, would you trade places with Warren Buffet today? I would argue not many under the age of 80 would.

As financial advisors, we concentrate our conversations on goal setting and achievement. Although building and protecting wealth is primary, we find many other goals come down to the balance of time, health, and money. Clients often think at retirement they will reach the mecca, aligning all three factors (money leading the way and typical focus of most). We know from experience; health often becomes a limiter later in life and can be a major detriment to long-term planning. Shifting some financial abundance to earlier years may lead to overall happier and more full lives without sacrificing security in later years. Therefore, helping to understand these dynamics and guiding our clients to live fully at every stage of life is paramount.

No matter what stage of life you are currently in, having a plan in place is key. By strategically planning, we can work to enhance our clients lives today and help secure a lasting and fulfilled future. Living for today while keeping an eye on the future is the winning formula to a well-balanced and full life.

"Be Fearful When Others Are Greedy. Be Greedy When Others Are Fearful."

- Warren Buffett

"The Four Most Dangerous Words in Investing are 'This Time is Different.'"

- Sir John Templeton

As we are now halfway through 2024, the market has continued to rally, led by Nvidia, up 175% YTD as the hype of Artificial Intelligence continues. At the time of writing this letter*, Nvidia has become the largest US company, surpassing Apple and Microsoft. The last time a major provider of computing infrastructure held the title of the most valuable U.S. company was in March 2000, when networking-equipment company Cisco claimed that spot during the dot-com boom. Feel free to look at the results of Cisco over the following years. Spoiler alert: Cisco is still down 40% from those highs almost 25 years later.

While Nvidia and other hot tech stocks continue to surge, high-quality stocks that pay dividends have seen a modest 2% increase this year, and high-quality bonds are down about 1%, marking the fourth year of the longest recorded bear market in bonds. In recent months, some clients have inquired about taking on more risk with their portfolios. “Why own these conservative, boring traditional value stocks or bonds? Instead, let’s jump on the A.I. or Crypto trains, as that’s what everybody is making money on these last 18 months.” It is during these moments that we reflect on the two quotes that opened this letter.

So, are the markets currently pricing in fear or greed? A key indicator to consider is the VIX, commonly referred to as the "fear index." The VIX is currently at its lowest point since November 2019 (right before a global pandemic), indicating a Goldilocks market sentiment filled with sunshine and rainbows. However, it's important to remain cautious during times of extreme positivity, as it may signal potential risks ahead.

Looking back at market history, we can see instances where investors shunned diversification in favor of chasing performance, only to face significant setbacks:

- Gold in the early 1980s: After the inflationary period in the 1970’s, Gold rallied and hit an all-time high in 1981, at an inflation adjusted $2,250 an ounce. As everybody was demanding Gold in their portfolios, the next 20 years was a fall from grace, as Gold crashed all the way down to $450 while the rest of the markets roared higher. Just recently, Gold has finally recovered and reached a new all-time high this year.

- Japanese Stocks in the late 1980s: During the Japanese asset price bubble in the late 80s, investors poured money into Japanese stocks and real estate, while avoiding other global markets. When the bubble burst in 1990, Japanese stocks entered a massive period of underperformance, only recently recovering and hitting a new high in March 2024, only 34 years later.

- Tech Stocks in the Late 1990s: During the dot-com bubble in the late 1990's, investors flocked to technology stocks, avoiding value stocks and bonds, and chasing the great returns in technology with the hype of this new thing called the World Wide Web. (Sound familiar?) When the bubble burst in 2000, everyone's favorite heavy technology investment, QQQ, had a drawdown of -83% from March 28th 2000 to October 7th 2002, when the tech wreck finally bottomed out. It took a whopping 13 years to finally get back to even if you were that investor in March of 2000.

- Real Estate in the mid-2000s: Leading up to the 2008 financial crisis, many investors poured money into real estate, particularly subprime mortgages and mortgage-backed securities. You simply couldn't lose money if it had to do with real estate. When the housing bubble burst, real estate prices plummeted, dragging pretty much all stocks down while high quality bonds held strong, one of the only positive asset classes in 2008.

- Commodities in the early 2010s: After the global financial crisis, investors sought refuge in commodities like oil, gold, and agricultural products and wanted nothing to do with the stock market. Of course, stocks went on having the one of the best decades of all time, while commodities delivered a real negative return over the same time.

We can go on and on, and no, this time isn’t different. When your uber driver is talking about how much money they made on Nvidia and Bitcoin, we may be approaching serious bubble territories, and the bigger the bubble, the bigger the pop.

We know this letter sounds a little more bearish than usual. While we are not predicting a specific downturn or advising to liquidate your investments, we believe there may be an overconcentration issue in the market, particularly in certain sectors. There are other areas to invest rather than just US Large Cap Growth Stocks and we need to remove our recency bias goggles. Diversification remains key to managing risk and ensuring long-term financial stability and we encourage maintaining your balanced portfolio that includes a mix of investments to navigate all types of market fluctuations. We want parts of your portfolio to zig, and other parts to zag at practically all times, which will smoothen out the ride to help accomplish your financial goals.

How one invests should largely depend on their goals, financial plan, risk tolerance and time horizon. A major component of our job is to help them figure these things out for their unique situation. If you have any questions or concerns about your portfolio's risk profile, please don't hesitate to reach out to any of our team members for an updated risk tolerance analysis tailored to your specific needs. As we move into the second half of the year, we wish you a wonderful summer and continued success in your financial endeavors.

*June 24, 2024

The opinions expressed are those of Freund & Smith Advisors as of the date stated on this material and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

As a multi-generational firm, we have clients of every age and stage of life. And as good financial planners, we take an interest in not only being a part of a client’s financial life, but their personal lives as well. We hear their struggles, their wins, and their goals. We take an interest in what is going on with them personally and professionally and we try to offer advice on topics that may not always fall within the purview of a client’s financial plan.

We all have a lot of life going on outside of meeting for our financial reviews a few times a year. We want you to know that we hear you and that you are not alone in your struggles or your successes. We recently learned about the book, Decade by Decade by Bobb Biehl. In this book, Bobb talks about the various decades of life and what word(s) are best associated with them and why. Here is a brief breakdown:

0-10: Security

Teens: Self

20s: Survival

30s: Success

40s: Significance and Struggle

50s: Stride

60s: Strategic

70s: Succession

80s: Slippery

90s: Sleep

Bobb talks about how a child needs unconditional love which will build lifelong confidence. He states that after interviewing over 5,000 people in his 40-year career, he has found that the single most shaping year of a child’s life is age 9. This is when one’s comfort zones are established. During the teenage years, one is typically quite selfish and is keen to comparing themselves and what they have to their friends and especially today on social media. Parents need to help them relax and teach them they do not need to compare themselves to others. They should take them to other areas of the world to see how little many people their age have.

Bobb Biehl states that every 20–22-year-old is worried about whether they can survive in the adult world. They need reassurance that they don’t need to change the world, especially when they are constantly asked what they are going to do with the rest of their lives. Those in their 20s need to take the time to decide what you want to do in life, try out different things to determine what you like. Also, build healthy habits from a young age, such as learning to save a portion of your income and live off the rest.

Those in their 30s are fixated on success, but Bobb asks, do you know what success is? Most don’t. Success is simply a feeling. Don’t let material things or promotions be all that you define as success.

Bobb then progresses into those in their 40s. Significance and struggle are the words to define this generation. He notes to keep in mind that you don’t have to be rich yet! This is a decade in which many people are looking to be rich, to have their hard work pay off. But the decade in which you make the most money and have the most significance is in your 60s. If you can pay your mortgage, take your kids to school, and save for their education, you are much farther than most people so don’t forget that. 45-50 is the time where people struggle the most. This group has the most cases of divorce, infidelity, and pressures between work and raising teenagers. Just keep in mind that this too shall pass.

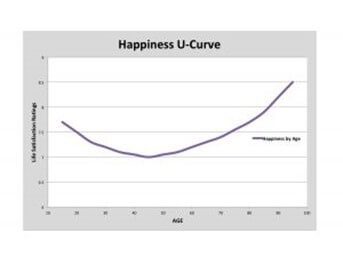

When you hit your 50s you have finally hit your stride and it feels almost like an overnight sensation. Every person he interviewed had many moments between 50-53 that they felt old and past their peak. However, the happiness curve and Bobb’s own 40 years of data suggest that one doesn’t hit their peak until their 60s. Bobb suggests making a list of your life milestones as nothing motivates an individual quite like results. Take the time to ask yourself if you are doing what you want to be doing in your 60s? If not, it’s not too late to make a change. Define what you want to do in your 60s and set yourself up to achieve those goals.

The most productive decade of your life is in your 60s. Your natural energy may be decreasing, but your strategic thinking is increasing. Studies show that today’s 75-year-olds feel approximately as old as their parents felt at 65. He also notes to not let a standardized retirement age of 65 lead you to believe that you must retire at that time. You are most successful when you can choose when you want to retire. This doesn’t have to mean working a full-time job. Many of our clients choose to continue to consult or do other part time work to seek fulfillment.

The most important thing to those in their 70s is succession. Those individuals worry relentlessly about everything that they’ve built and who is going to take over when they are not there. Maybe a business owner is worried about whether their kids are ready to take over the business. Bobb Biehl suggests writing out your memories in advance as this is the single greatest way you can leave an impact on future generations.

Next, we get to those in their 80s. Bobb uses the term slippery for this generation as most people see many friends and peers dying, their finances may be slipping, etc.

Finally, for those that are fortunate enough to see 90. There wasn’t a single one of them that Bobb interviewed during his career that didn’t use the word sleep. He said that most people fear how they will die, and they all hope that they will just fall asleep and not wake up as they don’t want to suffer as they have seen some of their friends and family. He suggests as a child of a parent in their 90s, set an ideal time every day to call them for the rest of their life. They will look forward to that phone call, if even for just a few minutes each day.

We thoroughly enjoyed the book, Decade by Decade by Bobb Biehl. Some of our biggest takeaways were gaining a greater understanding of what others in our family, friends, and on our own team are going through which allows us to be more sensitive to it. We all need to take the time to relax with where we are in life, and we encourage you to do the same. If you are interested in a copy of Bobb’s book, please let us know and we’d love to send one to you.

You’ve fine tuned your resume, you’ve completed countless applications and interviews, and you’ve finally accepted your first job. Congratulations! You’ve done so much to get to this point, but now what? New college graduates have much to consider and plan for when starting their first job. Our firm focuses on helping our clients make sound financial decisions throughout a career with the goal of building generational wealth no matter the stage in your life.

Here are some important tips for you as you start your first job:

- Understand your Benefits- This consists of traditional benefits such as 401(k) options, healthcare, and paid time off. Your compensation is more than just your salary so be sure to have a full understanding of what your options are and how to best choose what works for you. Some benefits to think about:

- Roth or Traditional 401(k)

- Investment Selection

- HSA Enrollment

- HMO vs. PPO

- Stock Plan Enrollment

- Paid Time Off

- Make a Budget- Once you know your net monthly income (your salary minus benefits and income taxes), make a budget. We have templates to help. Consider the following items in your monthly budget:

- Rent/Mortgage

- Renter’s or Homeowner’s insurance

- Utilities

- Health care costs

- Groceries

- Car expenses (car payments, insurance, maintenance)

- Transportation costs (gas, public transportation, parking)

- Debt repayment (student loans, credit cards, etc.)

- Miscellaneous (travel, TV streaming subscriptions, entertainment, cell phone, gym memberships, etc.)

- Establish a Savings Plan- Your goal should be to save 20% of your gross income. Creating a plan with intentionality and purpose early on in your working career will lead to healthy habits as you get older and your income increases. A basic template for savings shown below:

- Short-term (0-3 years)

- Mid-term (3-10 years)

- Long-term (10+ years)

- Understand your Student Loan Repayment Options- The average student loan borrower pays between $200 to $299 per month* on student loan debt. Most loans offer a six-month grace period post-graduation before payments begin. Make sure to know what you owe and what the minimum payment will be. Federal student loans offer benefits that private student loans don’t including income-driven repayment plans, deferment periods, potential student loan forgiveness, etc. Refinancing is also an option that could be considered with many factors such as interest rates that should be taken into account.

- Your 3/5/10 Year Vision- You manifest success with proper planning and positivity. Set your goals for three, five and ten years post-graduation. By taking the time to do this and being strategic with your career moves based on these goals, you will be years ahead of your peers. If you don’t have a plan or a path to where you are going, odds are you will end up somewhere else!

We are here to help. Schedule a complimentary consultation with a member of our team to create a plan that is right for you.

*U.S News March 10, 2023 https://money.usnews.com/loans/student-loans/articles/average-student-loan-payment

Being charitable, being involved in our community is one of our core values at Freund & Smith Advisors. We have made it a focus to get involved in our local community as well as support the organizations that mean the most to some of our clients. Each quarter we focus on a new organization to volunteer as a group or provide support to enhance their cause. Some examples of this are creating new home care packages for victims of domestic abuse at House of Peace, tuition payments for a student through One Heart Uganda, and putting together chemo kits and blankets for The Cancer Support Center. This has truly been one of the most rewarding ways for us to learn more about our clients and what matters most to them.

For us, we believe in teaching kids to be kind, selfless and involved in their communities starting at a young age. One example of this is our very own Kennedy Smith, daughter of one of our partners, Kyle. She was awarded the Justin Wynn Award which is presented to two fourth graders annually from each Evanston elementary school. Recipients are awarded based on their leadership, citizenship and sportsmanship qualities and they have the opportunity to participate in 3-5 service projects each month. Kennedy will be a part of this outstanding organization through high school. Kyle has also gotten involved with The Justin Wynn Leadership Academy by helping organize one of their largest fundraisers, their 3-on-3 basketball tournament, held on March 10th this year which Freund & Smith Advisors sponsored.

Aside from our involvement as a firm and as a team, we encourage our clients and future clients who have a similar charitable mindset to make this a part of their financial plan. We do so in three main ways:

- We set up Donor Advised Funds for those who are looking for tax-deductible contributions and that want the ability to gift over time.

- We educate on Qualified Charitable Distributions to satisfy the annual required minimum distributions from their retirement accounts.

- We help them designate all or a portion of life insurance benefits to charitable organizations.

Charitable giving is just one way we, as a firm, choose to be involved in the communities we are a part of. We have built it into our business model and our own personal plans and hope we can do the same for you.

Kennedy Smith presented with Justin Wynn Award

With a new year comes new tax changes set forth by the IRS. As we get into tax season, we know the importance of staying on top of your financial plan. We work with our clients not as tax advisors, but to incorporate tax efficiencies into your plan, both while you are working and in retirement.

In 2024 there are five major changes you need to know:

- Income Tax Brackets- the marginal tax brackets were adjusted for inflation. Here is the breakdown:

- 10% for an individual earning less than $11,600 or married couples earning less than $23,200

- 12% for an individual earning over $11,600 and married couples earning over $23,200

- 22% for an individual earning over $47,150 and married couples earning over $93,300

- 24% for an individual earning over $100,525 and married couples earning over $201,050

- 32% for an individual earning over $191,950 and married couples earning over $383,900

- 35% for an individual earning over $243,725 and married couples earning over $487,450

- 37% for an individual earning over $609,350 and married couples earning over $731,200

- Standard Tax Deduction- The standard deduction was increased $1,500 to $29,200 for married couples filing jointly. Individual taxpayers and married couples filing individually can expect an increase of $750 for the standard deduction, or $14,600. Heads of households also had an increase of $1,100 for a total of $21,900

- Gift Tax Limit- The annual exclusion amount for gifts rose to $18,000 in 2024

- Contribution Limits for Retirement Plans- $23,000 is the new 401(k) plan max contribution in 2024. This also applies to 403(b) and most 457 plans. IRA contribution limits increased to $7,000 and the IRA catch-up contribution limits for people over the age of 50 were not changed

- Tax Credits and Deductions- ranges were increased for phasing out IRA contributions, Roth IRA contributions and those qualifying for the Saver’s Credit. Here is the breakdown:

- IRA contribution deduction phase out

- Individual taxpayer covered by retirement plan phase out range is now $77,000-$87,000

- A married couple both covered by retirement plans phase out range is now $123,000-143,000

- Individual taxpayer not covered by a retirement plan, but married to someone who is phase out range is $230,000-$240,000

- Roth IRA contributions are subject to income-based phase-outs

- Single and Head of Household $146,000-$161,000

- Married filing jointly $230,000-$240,000

- Income limit for the Saver’s Credit

- Individual/Married filing separately- $38,250

- Married filing jointly- $76,500

- Head of Household- $57,375

- IRA contribution deduction phase out

Reach out to us to see how tax-efficient planning is a key part of a good financial plan.

Source: 2024 IRS Tax Changes: What You Need to Know | SmartAsset

This publication is not intended as legal or tax advice. Financial Representatives do not render tax advice. Consult with a tax professional for tax advice that is specific to your situation.

The SECURE 2.0 Act is legislation that was passed in 2022 that was designed to help Americans save for their future with provisions that are designed to expand access to retirement plans, streamline administration for employer-sponsored retirement plans such as 401(k)s, and increase savings opportunities for employees. The act’s provisions have some rolling effective dates. Here are the three most important that you need to know for 2024:

529 distributions to Roth IRAs (Effective 2024)

The SECURE 2.0 Act allows tax and penalty-free rollovers from established 529 accounts to the 529 beneficiary’s Roth IRA.

- The rollover is subject to the annual Roth IRA contribution limits ($7,000 for those under 50 and $8,000 for those 50+ in 2024), reduced by any other IRA contributions made by that individual during that tax year. The Roth IRA owner must have earned income in the year of the rollover at least equal to the amount rolled into the Roth that year.

- Recent 529 contributions (within five years of the rollover) and earnings on those contributions cannot be rolled over to the Roth IRA.

- The amount rolled from the 529 to the beneficiary's Roth cannot exceed the aggregate contributions (and earnings on those contributions) made at least 5 years prior to the rollover.

- The Roth IRA contribution limitation based on the taxpayer’s adjusted gross income is waived for the rollover.

Qualified Charitable Distributions (Effective 2024)

Beginning in 2024, QCDs permit a one-time, $53,000 distribution from an IRA to a charitable remainder unitrust, a charitable remainder annuity trust, or a charitable gift annuity. This amount counts toward the annual RMD. The IRA QCD limit is now indexed for inflation ($105,000 in 2024). There are specific requirements which must be adhered to, so please consult with your tax professional.

Required Minimum Distributions (RMDs) (Effective 2024)

Changes the age to determine the Required Beginning Date for Required Minimum Distributions. There seems to be a drafting error in which those born in 1959 meet both the age 73 and age 75 definitions. This will need to be corrected in future legislation, although we do not know what form the correction may take.

- Born 1950 or earlier: April 1 of the year following the year in which the taxpayer turned age 72

- Born 1951 – 1959: April 1 of the year following the year in which the taxpayer turned age 73

- Born 1959 or later: April 1 of the year following the year in which the taxpayer turned age 75

This publication is not intended as legal or tax advice. Northwestern Mutual and its Financial Representatives do not give legal or tax advice. Taxpayers should seek advice regarding their particular circumstances from an independent tax advisor. Tax and other planning developments after the original date of publication may affect these discussions.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI (life and disability insurance, annuities, and life insurance with long term care benefits) and its subsidiaries.

As we approach the end of the year, we start to reflect on what we have accomplished in the past 12 months, along with what the new year will bring. We set our goals and resolutions, draft our business plans and review our financial plans. But no plan is complete without an estate plan.

Many of our clients choose to work with us because of the expertise that we bring and the plans we create for each and every one of them. None of those plans would be complete without an estate plan. Not just for the wealthy, having these essential documents is key for an estate of any size. These documents help you plan for your family when you cannot. They work hand in hand with your financial plan. If you die prematurely, they dictate where your dollars will go and when. The documents spell out whom we should work with if you were to suffer from diminished capacity, and estate planning can remove assets out of your estate for tax efficiency purposes.

There are many questions to ask to meet your individual objectives. We are here to be a resource. We work with many estate attorneys that we can recommend or have more cost-effective alternatives such as an online platform, Trust & Will. If you already have an estate plan, that is great! When was the last time you reviewed that plan or made modifications to it? No matter which way you choose to implement or review your estate plan, do it. Don’t let it be another failed New Year’s resolution.

We take pride in the work we do for our clients. Our most successful client relationships come from those that have good behavioral economics and management. What is behavioral economics you ask? It’s the theory that examines the differences between what people “should” do, what they actually do, and the consequences of those actions.1 We know we need to exercise, to save for our kid’s college education, retirement, and have a holistic financial plan. The consequences of not doing so include poor health both literally and financially.

Any relationship between client and advisor must be one built on trust and understanding of the client’s goals, habits and discipline. Our advice is an outside voice that removes emotions from our recommendations, helping you take a more neoclassical approach. As human beings, we are subject to impulsivity, and we tend to be influenced by our environment and circumstances. Having that objective outside voice encourages you better understand your economic behavior.

A nudge in behavioral economics is a way to encourage people’s choices to make specific decisions. For example, putting fruit near the check out at a cafeteria to get people to choose healthier options. The same can be said for creating a holistic financial plan. By reviewing your entire financial picture, you can run scenarios to illustrate the choices you make today and the impact they have on your future.

If you have not reviewed your financial plan in a while, or have yet to start, we encourage you to do so today.

1 What is behavioral economics? | University of Chicago News (uchicago.edu)

As we hit the halfway point through the Summer, the look ahead to the start of school begins. For some, this includes getting a fresh box of crayons and scissors for your Kindergartener. For others, getting your plan in place to send your recent high school graduate off to college. While the nervous but excited feeling for parents may be similar in both cases, the cost for each varies quite a bit. Here are 5 ways to help pay for upcoming college costs:

- Application to FAFSA

The first step for every family looking to send a child to college is to complete the Free Application for Federal Student Aid. This application allows the student to receive federal aid like grants, work-study opportunities, and even federal student loans. You can also qualify for state-level and school-based aid. Make sure to submit the FAFSA as soon as possible as some colleges award both need- and merit-based money on a first-come, first-served basis. - Search/Apply for Scholarships

You would be very surprised to find that there are many scholarships available. Whether a few hundred dollars or more substantial, the opportunities are out there for the taking. Scholarships, unlike student loans, don’t have to be paid back. Thousands are available; use the Department of Labor’s Scholarships Finder to get started. While many scholarships require that you submit the FAFSA, most also have an additional application. - Grants

If you submit the FAFSA application and renew it each year you are enrolled in school, you may receive Pell money if you’re eligible for it. In addition to the need-based Pell program, the federal government offers several other types of grants, which also don’t need to be paid back in most cases. Many states have grant programs, too. Use the Education Department's state education contacts and information locator to find the agencies in your state that administer college grants. Then look up and apply to state grant programs you may qualify for. - Work Study

A work-study program provides part-time employment opportunities while you are in school. Available to undergraduate, graduate, and professional students, work-study helps those with financial need pay for tuition costs, fees, or other costs like room and board. The U.S. Department of Education reports that there are roughly 3,400 participating post-secondary institutions offering work-study on or off-campus. If you qualify, make sure you take advantage of it while you’re in school. - 529 Plans/Savings

A 529 college savings account is a state sponsored and tax advantaged way to save and pay for college. To ensure favorable tax treatment and avoid a 10% penalty, all distributions from 529 plans must be for qualified expenses , such as tuition, books as well as room and board. Any other savings or investment accounts can also be used to fund a college education (depending on invested assets, some taxation could apply). - Federal and Private Student Loans

Borrowing money through federal student loans is also one of the most common methods of paying for college. Federal loans, which are issued by the government, are categorized into two types for undergraduate students: direct subsidized (based on financial need) and direct unsubsidized loans (not based on financial need). They offer a low fixed interest rate and flexible repayment options. Federal student loans do have annual and lifetime limits, putting a cap on how much you can borrow through federal loans alone. Private student loans are provided by banks, credit unions, and other private lenders, and should be used to pay for college costs that are not covered by scholarships, grants, savings, or federal financial aid. With private student loans you can borrow up to 100% of your cost of attendance which can include tuition, fees, room & board, and other college costs. Private student loans offer variable or fixed interest rates, and you can pay them while you are in school or when you graduate.

We’ve heard it for years now, scammers are out there. We are conscious of the stories depicting a stranded family member or friend in a foreign country who needs money wired immediately, the hacked email attempts to gain access to your accounts, or get rich quick schemes. However, in the 30 years since the internet was made available to the public, consumers are more vulnerable than ever.

According to the Federal Trade Commission (FTC), consumers reported losing more than $3.8 billion to investment scams in 2022. That amount more than doubled since 2021! Technology has advanced to such an extent that Artificial Intelligence (AI) is now being used to clone voices of your loved ones. The FTC is warning of scammers using cloning programs, along with short clips of audio posted online of family member’s voices. Consumers receive calls and it sounds exactly like their loved ones.

These scam attempts are targeting consumers of all ages. There was a story in the news recently of a 15-year-old girl kidnapped and a $1 million ransom demanded of her mother. When the mother called her husband, who was on a ski trip with their daughter at the time, he was able to confirm that she was indeed safe with him, despite the mother being convinced it was her daughter’s voice she heard on the phone.

So, what can you do to protect yourself? First, if it seems fishy, it probably is. Trust your instincts, not the voice. Call the friend or family member directly at a phone number you know is theirs. If they don’t answer, try other modes of contact, or get in touch with someone else who knows their whereabouts. Another safety measure is to create a code word or phrase that only you and your loved ones know about. If a call is ever suspicious, you can use this to help authenticate the caller.

The FTC states that most of the scammers are asking you to pay or send money in methods that make it difficult to recover the funds. This includes wire transfers, paying in cryptocurrency, or buying gift cards. 2 All of these should raise a red flag of caution.

As your trusted advisors, we are here to help. Our mission is to keep you informed, not just about your portfolio performance, but also news you can use to keep you and your family safe.

Scammers use AI to enhance their family emergency schemes | Consumer Advice (ftc.gov) 3/20/23

Fake Kidnapper Cloned Girl's Voice in AI Scam Call to Mother: Report (businessinsider.com) 4/13/23

We spend a lot of time working with clients to save for their short-term and long-term goals. One of the most common concerns our clients have is saving enough for retirement. Our clients want to have a plan to retire when they want and have confidence in their plan even during market down turns. This article does a great job of laying out some of the major milestones our clients reach toward retirement and some of the changes to expect now that the SECURE Act has gone into effect.

Most parents don’t feel that they have enough resources needed to teach their kids about money and they don’t know to approach the topic with kids among different ages. Robin Taub, award-winning author of the best-selling book, The Wisest Investment: Teaching Your Kids to Be Responsible, Independent and Money-Smart for Life, was kind enough to sit down with Northwestern Mutual in an interview and provided some fantastic strategies for parents to teach their kids about money. Her approach includes teaching about the Five Pillars of Money: Earn, Save, Spend, Share and Invest. We encourage you to read the interview here: Raising Money-Smart Kids: A Q&A With Robin Taub | Northwestern Mutual. It’s never too late (or early) to help our kids learn financial literacy!